Karnataka Rastriya Education Society

- principal@kascc.in.net

- +919343834635

Commerce

Year of establishment: 1970

Department of Commerce established in the year of 1970. The motto of the department is to provide quality education to students, which will lead them sustain peaks in the field of Commerce and Business. The department is loaded with competent faculty to teach and guide the students. The Department also offers Post Graduate in Commerce (M.com). It believes in nurturing and developing professional competencies in students through quality education, research and continuous innovation. It also grooms the students with an aim to make them industry ready professionals with hands on knowledge in their selected field of specialization to effectively contribute to society with commitment and integrity.

From the inception of the department, it has produced more than 5000 Graduate students. The students of the department are serving the society by occupying the prominent positions in various Universities, Corporates, Colleges, Government departments and also by their own business establishments etc. The Department provides various platforms for the students to nurture skills innovate and build leadership through various curricular and extracurricular activities.

Objectives:

- To create healthy environment for teaching, learning through generating and providing resources and facilities to the faculty and the students for generating innovative ideas.

- Provide conducive environment for quality education in commerce, Entrepreneurship and Research through innovative and healthy practices with commitment to achieve the higher level of Excellence.

- To create academic excellence in accounting and financial skills, team spirit, leadership qualities among students to meet the challenges of the business world.

- Inculcate ethical and moral values by offering a support system which is friendly and inspiring the future nation builders.

- To liberate the young minds from the shackles of ignorance and motivate them to face the complexities of life efficiently with a sense of self-respect, social consciousness and national pride.

Programmes Offered:

Sl. No. | Programmes Offred | Year of Establishment |

1 | Bachelor of Commerce (B.Com) | 1970 |

2 | Masters of Commerce (M.Com) | 2012 |

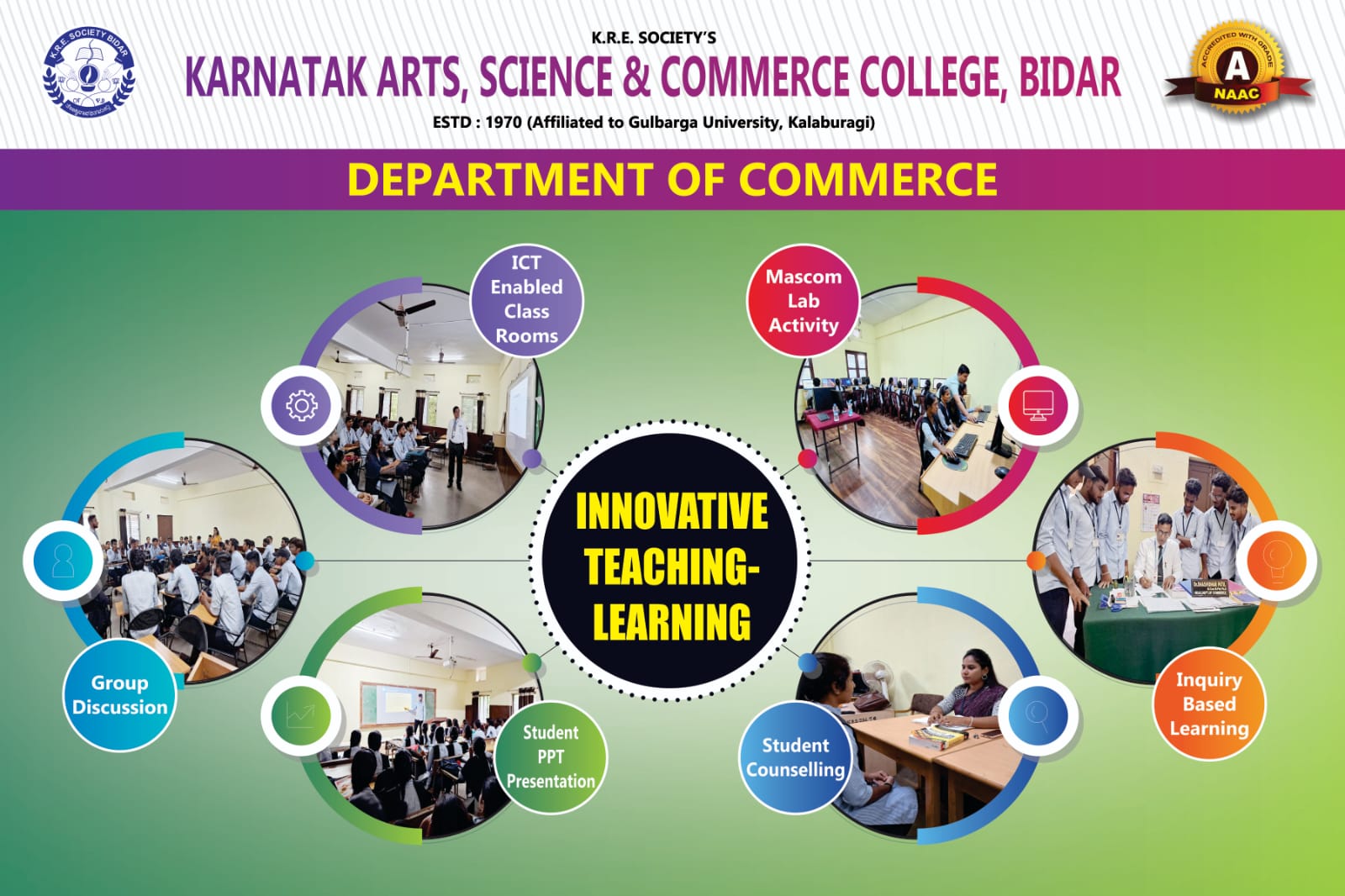

MASCOM LAB (COMMERCE LAB): Management Secretarial Practice and Commerce Laboratory established in the year 2006 to provide much needed practical exposure to the students in the field of Commerce and Management. It helps students and staff members keep abstract of the latest development in the business world.

Mascom Lab Activities:

- Tally Course

- Banking Affairs

- Digital-Marketing and Advertisement

- Preparation of AOA & MOA

- Procedure for Incorporation of the Company

- Teaching computer practical skills

- Poster Making Competition

- Stock Trading

Add-On Courses and Certification Courses

Add-On Courses and Certification Courses increase the chances of getting job and a lucrative career along with improving professional skill and knowledge of the students. The following are the Add-on Courses and certification Courses are offering by the department:

- Tally – ERP 9

- Retail Management

- Customer Relationship Management

- Data analysis Using Spread Sheet

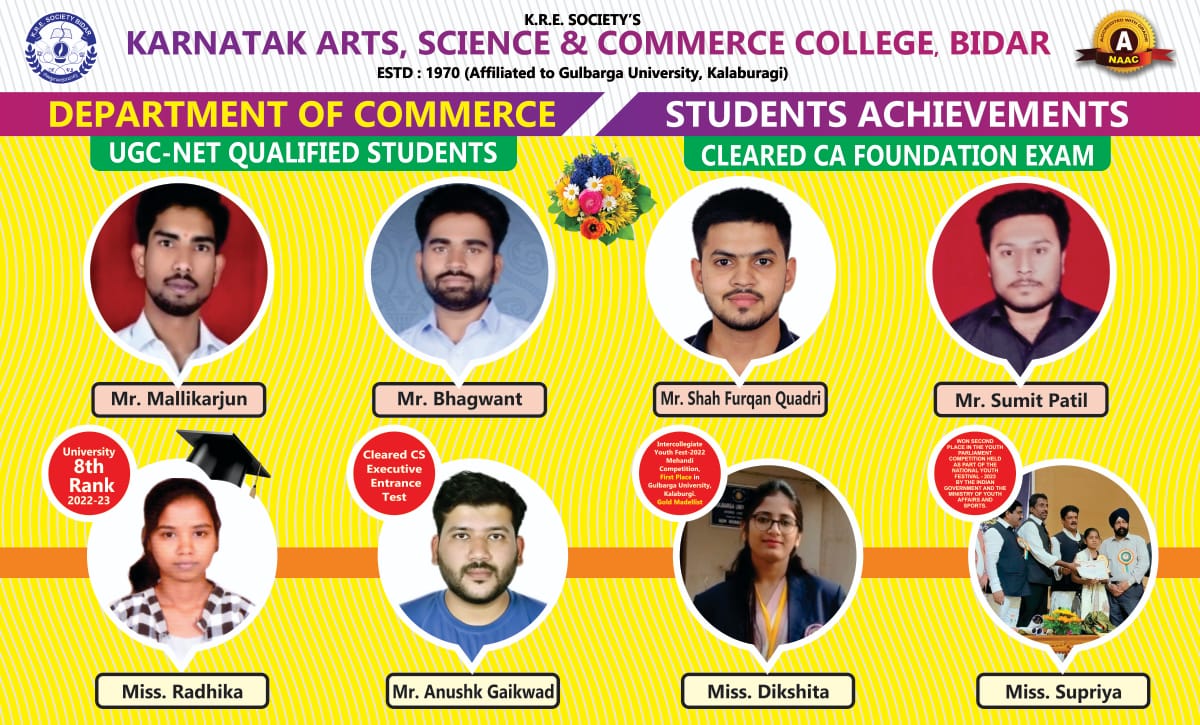

Competitive Exam Coaching Classes:

Following coaching classes will be conducted by the department on regular basis

- Bank Exam Coaching classes

- NET/KSET Coaching classes

B.Com Programme Outcomes (POs)(As Per CBCS)

PO1. Disciplinary Knowledge:

Graduates will develop the specialization and in-depth content knowledge of subjects in commerce and they build up the capability of executing comprehensive knowledge and understanding of new discipline of Commerce.

PO2. Communication Skills:

Graduates will acquire the ability to communicate ideas effectively in both written and oral formats and they will be proficient in communicating through presentations, seminar, written reports.

PO3. Critical Thinking:

Graduate will gain the ability to analyze information objectively and make a reasoned judgment and they improve independent thinking by understanding the concepts in every area of Commerce and Business.

PO4. Problem solving skill:

Graduate will possess the capability to deduce a business problem and apply the class room learning into practice to offer a solution for the same.

PO5. Research and Development:

Graduate will acquire the ability to conduct independent research and explore the emerging branches in the field of commerce and business. They also improve the ability of search, extract, organise and analyze the data and information.

PO6. Information and Communication Technology (ICT) Digital Literacy:

Graduates improve the capability to use various technical (ICT) tools like PPT presentation, Zoom class etc. They also learn how best they can use online platform for leaning.

PO7. Self-Directed Learning:

Graduates will build the capability to work independently in diverse projects and ensure detailed study of various facets of Commerce and Business. Capability of self-paced and self-directed learning aimed at personal development and for improving knowledge/skill development and rescaling in all areas of commerce.

PO8. Moral and Ethical Awareness/Reasoning:

Gradates develop the ability to ascertain what is ethical and unethical behavior, what is good and bad in business, and demonstrate awareness of the social, legal and ethical implication of commerce and business to make responsible decision in their professional careers.

PO9. Teamwork and Collaboration:

Graduates will acquire the ability to work in interdisciplinary teams in the most effective and efficient way to achieve a common goals and collaborating with individual from different backgrounds to solve complex problems.

PO10. Leadership and Managerial skills:

Graduates build the leadership qualities within them to lead the team, project and resource efficiently, they also develop the ability to plan, organize and execute the resource (Men, Money and Material) effectively.

Programme Specific Outcomes

Upon completion of B.Com Degree Programme the graduates will be able to develop the following programme specific outcomes.

PSO1. Develop and implement traditional and modern strategies and skills practices of Accounting, Costing, Banking, Economics, Marketing, Management, Finance, Auditing and Taxation.

PSO2. Practice different techniques of communication, leadership and managerial skills and apply it in business and profession.

PSO3. Apply different concepts in starting and managing business and realize the social responsibilities, social realities and inculcate an essential value system

Course Outcome -Programme Outcome Mapping

| Courses / PO’s | PO1 | PO2 | PO3 | PO4 | PO5 | PO6 | PO7 | PO8 | PO9 | PO10 |

| Financial accounting- I |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Principal of marketing |

✓ |

✓ |

|

✓ |

✓

|

✓ |

✓ |

✓ |

✓ |

✓ |

| Financial Accounting-II |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Principals of Management |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

| Corporate Accounting – I |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Human Resource Management |

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

| Small Business Management |

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

|

✓ |

✓ |

| Corporate Accounting – II |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Corporate Administration |

✓ |

|

|

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

| Indian Banking |

✓ |

|

|

|

✓ |

✓ |

✓ |

✓ |

| |

| Management Accounting |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Auditing |

✓ |

|

✓ |

✓ |

|

✓ |

✓ |

|

✓ | |

| Business Environment |

✓ |

✓ |

|

✓ |

✓ |

✓ |

|

✓ |

|

✓ |

| Business Law |

✓ |

✓ |

|

✓ |

|

|

|

✓ |

|

✓ |

| Banking Operations and Insurance |

✓ |

|

|

|

✓ |

✓ |

✓ |

✓ |

| |

| Income Tax – I |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Cost Accounting – I |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Financial Management |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Indian Financial System |

✓ |

✓ |

✓ |

✓ |

|

✓ | ||||

| International Trade |

✓ |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ |

| Goods and Services Tax |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Computer Application for Business and E-Commerce |

✓ |

✓ |

✓ |

✓ |

✓ | |||||

| Income Tax – II |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Cost Accounting – II |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ |

CO-PO Target Attainment

Courses / PO’s | PO1 | PO2 | PO3 | PO4 | PO5 | PO6 | PO7 | PO8 | PO9 | PO10 |

Financial accounting- I |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

Principal of marketing |

2 |

2 |

|

2 |

2 |

2 |

2 |

2 |

2 |

2 |

Financial Accounting-II |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

Principals of Management |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

Corporate Accounting – I |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

Human Resource Management |

3 |

3 |

|

3 |

3 |

3 |

3 |

3 |

3 |

3 |

Small Business Management |

2 |

2 |

|

2 |

2 |

2 |

2 |

|

2 |

2 |

Corporate Accounting – II |

3 |

|

3 |

3 |

|

|

3 |

|

3 |

|

Corporate Administration |

2 |

|

|

2 |

2 |

2 |

2 |

2 |

|

|

Indian Banking | 2 |

|

|

| 2 | 2 | 2 | 2 |

|

|

Management Accounting |

2 |

2 |

2 |

|

|

|

2 |

|

2 |

|

Auditing |

2 |

|

2 |

2 |

|

2 |

2 |

|

2 |

|

Business Environment |

2 |

2 |

|

2 |

2 |

2 |

|

2 |

|

2 |

Business Law |

2 |

2 |

|

2 |

|

|

|

2 |

|

2 |

Banking Operations and Insurance |

3 |

|

|

|

3 |

3 |

3 |

3 |

|

|

Income Tax – I |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

Cost Accounting – I |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

Financial Management |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

Indian Financial System |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

International Trade |

2 |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

Goods and Services Tax |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

Computer Application for Business and E-Commerce |

2 |

|

2 |

2 |

2 |

2 |

|

|

|

|

Income Tax – II |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

Cost Accounting – II |

2 |

|

2 |

2 |

|

|

2 |

|

2 |

|

CO-PO Attainment

Courses / PO’s | PO1 | PO2 | PO3 | PO4 | PO5 | PO6 | PO7 | PO8 | PO9 | PO10 |

Financial accounting- I |

1.4 |

|

1.4 |

1.4 |

|

|

1.4 |

|

1.4 |

|

Principal of marketing |

1.0 |

1.0 |

|

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

Financial Accounting-II |

1.8 |

|

1.8 |

1.8 |

|

|

1.8 |

|

1.8 |

|

Principals of Management |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

Corporate Accounting – I |

1.8 |

|

1.8 |

1.8 |

|

|

1.8 |

|

1.8 |

|

Human Resource Management |

2.2 |

2.2 |

|

2.2 |

2.2 |

2.2 |

2.2 |

2.2 |

2.2 |

2.2 |

Small Business Management |

2.0 |

2.0 |

|

2.0 |

2.0 |

2.0 |

2.0 |

|

2.0 |

2.0 |

Corporate Accounting – II |

2.2 |

|

2.2 |

2.2 |

|

|

2.2 |

|

2.2 |

|

Corporate Administration |

2.0 |

|

|

2.0 |

2.0 |

2.0 |

2.0 |

2.0 |

|

|

Indian Banking |

2.0 |

|

|

|

2.0 |

2.0 |

2.0 |

2.0 |

|

|

Management Accounting |

2.0 |

|

2.0 |

|

|

|

2.0 |

|

2.0 |

|

Auditing |

2.0 |

|

2.0 |

2.0 |

|

2.0 |

2.0 |

|

2.0 |

|

Business Environment |

2.0 |

2.0 |

|

2.0 |

2.0 |

2.0 |

|

2.0 |

|

2.0 |

Business Law |

2.0 |

2.0 |

|

2.0 |

|

|

|

2.0 |

|

2.0 |

Banking Operations and Insurance |

2.2 |

|

|

|

2.2 |

2.2 |

2.2 |

2.2 |

|

|

Income Tax – I |

1.2 |

|

2.2 |

2.2 |

|

|

2.2 |

|

2.2 |

|

Cost Accounting – I |

2.0 |

|

2.0 |

2.0 |

|

|

2.0 |

|

2.0 |

|

Financial Management |

1.8 |

|

1.8 |

1.8 |

|

|

1.8 |

|

1.8 |

|

Indian Financial System |

1.8 |

|

1.8 |

1.8 |

|

|

1.8 |

|

1.8 |

|

International Trade |

1.8 |

1.8 |

|

1.8 |

1.8 |

|

|

1.8 |

|

1.8 |

Goods and Services Tax |

2.0 |

|

2.0 |

2.0 |

|

|

2.0 |

|

2.0 |

|

Computer Application for Business and E-Commerce |

1.8 |

|

1.8 |

1.8 |

1.8 |

1.8 |

|

|

|

|

Income Tax – II |

1.8 |

|

1.8 |

1.8 |

|

|

1.8 |

|

1.8 |

|

Cost Accounting – II |

2.0 |

|

2.0 |

2.0 |

|

|

2.0 |

|

2.0 |

|

Average |

1.84 |

1.71 |

1.84 |

1.84 |

1.8 |

1.52 |

1.86 |

1.80 |

1.82 |

1.71 |

Course Outcome (COs)

Semester : 1

Course Name: Financial Accounting

Total Hours: 56

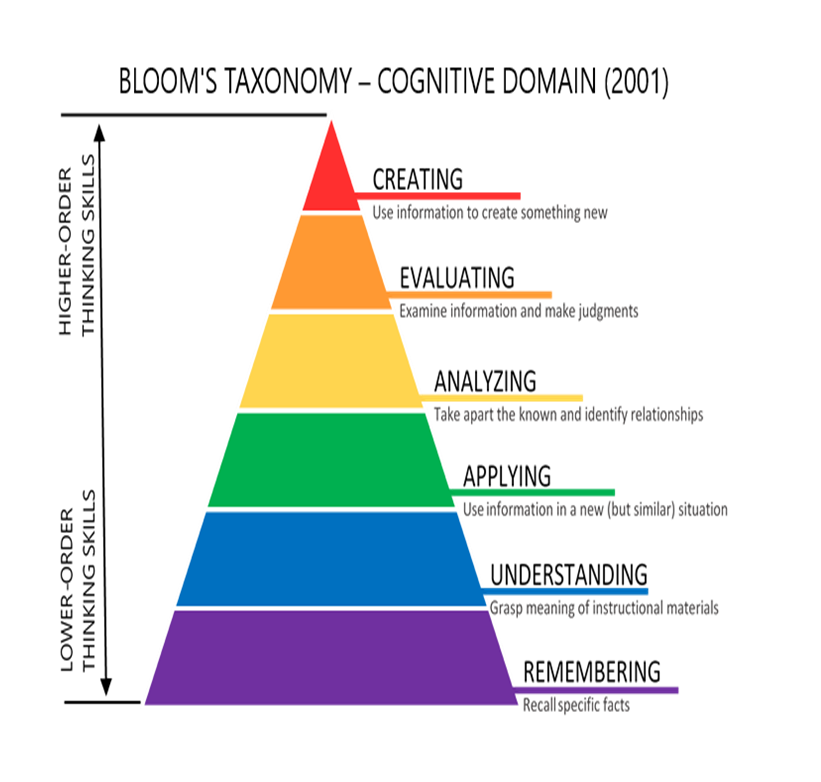

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understanding of theoreticalframework of accounting as well as accounting standards. | PO1, PO3, PO7, PSO1, | K2 |

CO – 2 | Demonstrate the preparation of financial statement of manufacturing and non-manufacturing entities of sole proprietors. | PO1, PO3, PO7, PSO1, | K3 |

CO – 3 | Exercise the accounting treatments for consignment transactions and events in the books for consignor and consignee. | PO1, PO3, PO7, PSO1, | K3 |

CO – 4 | Understand the accounting treatment for Bank reconciliation statement, to learn BRS reasons for differences in the balance as per pass book and cash book. | PO1, PO3, PO4, PO7, PSO1, | K3 |

CO – 5 | To enable the students to outline the treatments relating to sale of partnership. | PO1, PO3, PO7, PSO1, | K2 |

Semester: 1

Course Name: Principles of Marketing

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the concept of marketing, marketing mix, marketing environment and micro and macro marketing. | PO1, PO2, PSO1, PSO2 | K2 |

CO – 2 | Summaries the concepts of market segmentation. | PO3, PO4, PO9, PO10, PSO1 | K4 |

CO – 3 | Understand the meaning of product, product planning and development, product life cycle and brandingpackaging and labeling. | PO1, PO9, PO10, PSO1 | K2 |

CO – 4 | Demonstrate the concept of pricing and factors affecting pricing, elements of promotional mix. | PO1, PSO1

| K2 |

CO – 5 | Analyze channels of distribution and recent developments in Marketing. | PO1, PO5, PSO1 | K4 |

Semester: 2

Course Name : Financial Accounting – II

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the preparations of departmental accounts. | PO1, PO2, PSO1, PSO2 | K2 |

CO – 2 | Analyze the different type of Branch Accounts. | PO3, PO4, PO9, PO10, PSO1 | K4 |

CO – 3 | Determining the preparations of the Royalty accounts, concepts of lessor and lessee, journals and ledger in the books of lessor and lessee. | PO1, PO9, PO10, PSO1 | K2 |

CO – 4 | Understand the concept of hire purchase accounts. | PO1, PSO1

| K2 |

CO – 5 | Prepare the dissolution of partnership, Garner v/s Murray rule-insolvency of all partners. | PO1, PO5, PSO1 | K4 |

Semester: 2

Course Name: Principles of Management

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the basic concepts of Management and levels of management. | PO1, PO4, PO9, PSO1, PSO2 | K2 |

CO – 2 | Analyze the evolution of management and contributions of different Management Gurus. | PO1, PSO1 | K4 |

CO – 3 | Summarize the nature and importance of planning and steps in planning. | PO1, PO7, PSO1 | K2 |

CO – 4 | Give an idea about organization, departmentation and delegation. | PO1, PO9, PSO1 | K4 |

CO – 5 | Familiarize with directing, motivation theories, communication process and leadership. | PO1, PO2, PO9, PSO1 | K4 |

Semester: 3

Course Name: Corporate Accounting – I

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Enabling the students to understand the features of Shares and Debentures. | PO1, PO4, PO9, PSO1, | K2 |

CO – 2 | Develop an understanding about underwriting shares and debenture, redemption of Shares and Debenture and its types. | PO7, PO10, PSO1 | K2 |

CO – 3 | Understand an exposure to the company final accounts. | PO1, PO3, PO4, PSO1 | K4 |

CO – 4 | Analyze the concept of mergers and acquisition. | PO1, PO2, PO8, | K4 |

CO – 5 | Summaries about internal reconstruction and accounting for intangible assets. | PO3, PO10 PSO1 | K4 |

Semester: 3

Course Name Human Resource Management

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the concept of human resource management. | PO1, PO2, PO3, PO9, PO10, PSO2 | K2 |

CO – 2 | Summaries the process and importance of planning. | PO1, PO3, PO4, PSO2 | K4 |

CO – 3 | Analyze the different types of training and its effectiveness. | PO1, PO3, PO9, PO10, PSO2 | K4 K4 |

CO – 4 | Understand the concepts of performance appraisal and job analysis. | PO3, PO4, PO8, PO10, PSO2 | K2 |

CO – 5 | Retrieve the knowledge of welfare and safety measures in companies. | PO1, PO8, PSO1 | K2 |

Semester: 3

Course Name: Small Business Management

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the principles of business management and its scope and significance. | PO1, PO7, PSO3 | K2 |

CO – 2 | Analyse the emergence of entrepreneurship in Indian Industry and business. | PO7, PO8, PSO3 | K4 |

CO – 3 | Summaries the government policies and measures towards promotion of entrepreneurship. | PO3, PO4, PSO3 | K4 |

CO – 4 | Analyze the project management process. | PO1, PO5, PSO1 | K5 |

CO – 5 | Understand the concepts of small scale industries. | PO1, PO7 | K4 |

Semester: 4

Course Name: Corporate Accounting – II

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the concepts of accounts of banking companies. | PO1, PO4, PO8, PSO1 | K2 |

CO – 2 | Summerise the accounts of insurance companies. | PO1, PO5, PO6, PSO1 | K4 |

CO – 3 | Analyse the accounts of holding companies. | PO2, PO3, PSO1 | K4 |

CO – 4 | Understand the concepts of Valuation of shares and methods. | PO3, PO7, PSO1 | K2 |

CO – 5 | Analyse the concepts of liquidation and calculation of its final statements. | PO1, PO10 | K4 |

Semester : 4

Course Name : Corporate Administration

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the concept of company and characteristics of a company. | PO1, PO5, PSO1 | K2 |

CO – 2 | Understand the concepts of memorandum of association, articles of association, allotment and forfeiture of shares. | PO1, PO3, PO4, PSO1 | K2 |

CO – 3 | Analyse the role of company secretary under Companies Act 2013. | PO1, PO3, PO4, PSO1 | K4 |

CO – 4 | Summarize the types of meetings in Companies | PO1, PO3, PO4, PSO1 | K4 |

CO – 5 | Evaluate the Books of account and winding up of companies. | PO3, PO4, PO8, PSO1 | K5 |

Semester : 4

Course Name : Indian Banking

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the concept of Indian Banking System, types of Indian Banks. | PO1,PO5, PO7 PSO1 | K2 |

CO – 2 | Analyse the details about Indian Commercial Banks. | PO1, PO5, PSO1 | K4 |

CO – 3 | Summarize the role of RBI in agricultural financing and industrial development. | PO1, PO4, PO5, PSO1 | K4 |

CO – 4 | Analyse the recent trends in Indian banking. | PO5, PO9, PSO1 | K4 |

CO – 5 | Evaluate the concept of banking sector reforms. | PO4, PO5, PSO1 | K3 |

Semester : 5

Course Name : Banking Operations and Insurance

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the relationship of banker and customer. | PO1, PO3, PO4, PO8, PSO1 | K2 |

CO – 2 | Analyze the key concepts of lending operations. | PO1, PO5, PO3, PO4, PSO1 | K4 |

CO – 3 | Summarize innovative banking operations line E-Banking, Internet Banking, E-payments and ATM. | PO1, PO3, PO4 PSO1 | K3 |

CO – 4 | Understand the term Insurance and its types. | PO1, PO5, PSO1 | K2 |

CO – 5 | Understand the types of insurance claim and regulations. | PO1, PO5, PSO1 | K2 |

Semester: 5

Course Name: Management Accounting

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the financial statement analysis in management accounting. | PO1, PO3, PO4, PSO1 | K2 |

CO – 2 | Analyze the Fund Flow statement and its uses. | PO3, PO4, PSO1 | K4 |

CO – 3 | Analyze the Cash Flow statement and its use. | PO3, PO4, PSO1 | K4 |

CO – 4 | Analyze the concepts and Ratio Analysis. | PO3, PO4, PSO1 | K4 |

CO – 5 | Evaluate the importance management reporting. | PO1, PO2, PO3, PSO1 | K5 |

Semester : 5

Course Name : Auditing

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the fundamental concepts of auditing. | PO1, PO7, PSO1 | K2 |

CO – 2 | Analyze the Statement and Guidance notes on Auditing issued by the ICAI. | PO3, PO4, PO5, PO7 | K4 |

CO – 3 | Analyze the significance and objectives of internal control and concept and principles of Auditing, Audit process, Assurance Standards, Tax Audit, and Audit of computerized Systems. | PO3, PO4, PSO1 | K4 |

CO – 4 | Analyse the concepts of vouchers and verification. | PO1, PO3, PO4 | K4 |

CO – 5 | Evaluate the importance of audit report. | PO2, PO7, PSO1 | K5 |

Semester : 5

Course Name : Business Environment

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the characteristics and types of environment (Micro and Macro) and its effects on business. | PO1, PO5, PSO1 | K2 |

CO – 2 | Analyze the economic environment and its factors like GDP, per capita income, BOP Monetary policy and fiscal policy. | PO3, PO4, PO7, PSO1 | K4 |

CO – 3 | Summerise the factors of political and legal environment of business and its impact on business. | PO3, PO4, PO9 PSO1 | K3

|

CO – 4 | Understand the factors of socio-cultural environment of business and its effects. | PO1, PO4, PO8 PSO1 | K2 |

CO – 5 | Analyse the factors of technical environment and its impact on business. | PO1, PO3, PO4, PO5, PO6 | K4 |

Semester: 5

Course Name: Business Law

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the basic provisions regarding legal framework governing the business world. | PO1, PO2, PSO1 | K2 |

CO – 2 | Understand and applyof the regulatory framework of various Business Law viz. The Indian Contract Act, 1872, The Sales of Goods Act, 1930, Negotiable Instruments Act 1881, Consumer Protection Act etc. | PO1, PO3, PO4, PSO1 | K3 |

CO – 3 | Develop understanding of about technology act. | PO1, PO3, PO4 | K2 |

Semester: 5

Course Name: Cost Accounting – I

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the concept of cost accounting and methods of costing. | PO1, PO3, PO7, PSO1 | K2 |

CO – 2 | Outline the procedure and documentations involved in procurement of materialize and compute the valuation of inventory. | PO1, PO3, PO4, PSO1 | K4 |

CO – 3 | Analyse the contents of labour control system and methods of remuneration. | PO3, PO4, PO7, PSO1 | K4 |

CO – 4 | Estimating about the classification and allocation of overheads. | PO3, PO4, PSO1 | K5 |

CO – 5 | Analyse different cost control techniques and cost audit. | PO2, PO5, PO10, PSO1 | K4 |

Semester: 5

Course Name: Income Tax – I

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the in-depth knowledge on the provisions of Income Tax and familiarize the students with recent amendments in Income-tax. | PO1, PO5, PO7 PSO1 | K2 |

CO – 2 | Analyse the basic concepts and definitions of Income Tax Act 1961 | PO1, PO5, PSO1 | K4 |

CO – 3 | Summarize the computation of income from salary | PO3, PO4, PSO1 | K5 |

CO – 4 | Analyze the computation of income from house property | PO3, PO4, PSO1 | K4 |

CO – 5 | Analyze and summarize the computation of income from business and profession | PO3, PO4, PSO1 | K4 |

Semester: 6

Course Name: Computer Application for Business and E-Commerce

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Identify and analyze user needs and take them into account in the selection, creation, evaluation and administration of computer-based systems. | PO1, PO3, PO4, PO5, PO6, PSO2 | K4 |

CO – 2 | Ability to integrate IT-based solutions into the user environment effectively. | PO1, PO3, PO4, PO5, PO6, PSO2 | K4 |

CO – 3 | Ability to use current techniques, skills, and tools necessary for computing practice. | PO1, PO3, PO4, PO6 | K4 |

CO – 4 | Understand the concept of E-Commerce and its significance in present scenarios. | PO1, PO3, PO4, PO6 | K2 |

CO – 5 | Understand the contemporary trends in e-commerce and business finance | PO1, PO3, PO4, PO6 | K2 |

Semester: 6

Course Name: Financial Management

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the fundamental concepts of financial management and concepts of profit and wealth maximization and sources of finance. | PO1, PO3, PO4, PSO1 | K2 |

CO – 2 | Analyze the term cost of capital and capital structure. | PO1, PO3, PO4, PO5, PSO1 |

K4 |

CO – 3 | Summarize the different types of Capital Budgeting techniques. | PO1, PO3, PO4, PO5, PSO1 | K4 |

CO – 4 | Understand the factors determining dividend policy and working capital management. | PO1, PO3, PO4, PO5, PSO1 | K2 |

CO – 5 | Understand the financial market structure and recent trends in capital market. | PO1, PO3, PO4, PO5, PSO1 | K2 |

Semester: 6

Course Name: Indian Financial System

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Outline the structure and functions of the Indian financial system. | PO1, PSO1 | K2 |

CO – 2 | Illustrate the functioning of financial market and government security market in the development of Indian financial system. | PO1, PO3, PO4. PSO1 | K3 |

CO – 3 | Understand the concepts of money market and capital markets. | PO1, PSO1 | K2 |

CO – 4 | Outline the role of financial intermediaries. | PO1, PSO1 | K2 |

CO – 5 | Summarize the objectives and significance of financial regulation in India and role of SEBI in security market. | PO1, PO3, PO4, PSO1 | K4 |

Semester: 6

Course Name: International Trade

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the concepts of International Trade and theories of foreign trade. | PO1, PSO1 | K2 |

CO – 2 | Analyze the concepts of balance of payment. | PO1, PO3, PO4, PO5, PSO1 | K4 |

CO – 3 | Summarize the concepts of export management. | PO1, PO3, PO4,PO5, PSO1 | K3 |

CO – 4 | Understand the term international capital movement and Foreign Direct Investment. | PO1, PO3, PO4, PO5, PSO1 | K4 |

CO – 5 | Outline the role of World Trade Organization. | PO1, PO3, PO4, PO5, PSO1 | K2 |

Semester: 6

Course Name: Goods and Services Tax

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the structure of Goods and Services Tax (GST) | PO1, PO2, PO3, PO4, PSO1 | K2 |

CO – 2 | Examine the provisions available for levy and collection of GST | PO1, PO2, PO3, PO4, PO5,PSO1 | K4 |

CO – 3 | Understand the concepts of Input Tax Credit. | PO1, PSO1 | K2 |

CO – 4 | Analyze the GST procedures: Tax invoice, Credit and Debit notes, GST Computation. | PO1, PO2, PO3, PO4, PO5,PSO1 | K4 |

CO – 5 | Outline the special provisions available for GST in India. | PO1, PO2, PO3, PO4, PO5,PSO1 | K4 |

Semester: 6

Course Name: Cost Accounting – II

Total Hours: 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand elements of cost and solve numerical data of cost sheet in contract costing and process costing | PO1, PO3, PO4, PSO1 | K2 |

CO – 2 | Analyse the concept of marginal costing and its practical applicability. | PO3, PO4, PO5, PSO1 | K4 |

CO – 3 | Evaluating the use of budget and budgetary control in solving the numerical problems. | PO3, PO4, PO5, PSO1 | K5 |

CO – 4 | Understand about standard costing of material, labour and Overhead. | PO3, PO4, PO7, PSO1 | K4 |

CO – 5 | Analyse the knowledge on the theoretical outline of activity based costing. | PO1, PO2, PO6, PSO1 | K4 |

Semester: 6

Course Name: Income Tax – II

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Evaluate how to compute the income from capital gains. | PO1, PO2, PO3, PSO1 | K4 |

CO – 2 | Analyze how to compute Income from other Sources. | PO1, PO2, PO3, PSO1 | K4 |

CO – 3 | Evaluate the provisions and procedure to compute total income by an individual, Hindu Undivided Family and Firms. | PO1, PO2, PO3, PSO1 | K4 |

CO – 4 | Evaluate assessment of partnership firms – Provisions, Deduction and Computation of tax liability of firms. | PO1, PO2, PO3, PSO1 | K4 |

CO – 5 | Understand the assessment of Company – Indian company, foreign company and Computation of tax liability. | PO1, PO2, PO3, PSO1 | K2 |

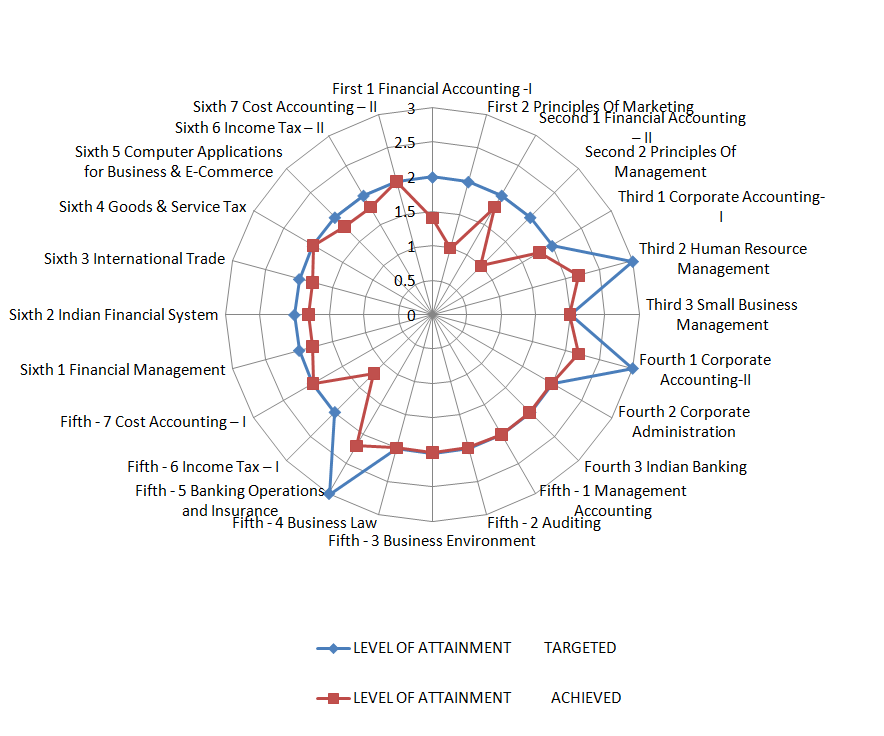

Level Of Attainment

Sem | Sl.No | Subjects | Level of Attainment | |

|

|

| Targeted | Achieved |

First | 1. | Financial Accounting –I | 2 | 1.4 |

2. | Principles Of Marketing | 2 | 1.0 | |

Second | 1. | Financial Accounting – II | 2 | 1.8 |

2. | Principles Of Management | 2 | 1.0 | |

Third | 1. | Corporate Accounting-I | 2 | 1.8 |

2. | Human Resource Management | 3 | 2.2 | |

3. | Small Business Management | 2 | 2.0 | |

Fourth | 1. | Corporate Accounting-II | 3 | 2.2 |

2. | Corporate Administration | 2 | 2.0 | |

3. | Indian Banking | 2 | 2.0 | |

Fifth – | 1. | Management Accounting | 2 | 2.0 |

2. | Auditing | 2 | 2.0 | |

3. | Business Environment | 2 | 2.0 | |

4. | Business Law | 2 | 2.0 | |

5. | Banking Operations and Insurance | 3 | 2.2 | |

6. | Income Tax – I | 2 | 1.2 | |

7. | Cost Accounting – I | 2 | 2.0 | |

Sixth | 1. | Financial Management | 2 | 1.8 |

2. | Indian Financial System | 2 | 1.8 | |

3. | International Trade | 2 | 1.8 | |

4. | Goods & Service Tax | 2 | 2.0 | |

5. | Computer Applications for Business & E-Commerce | 2 | 1.8 | |

6. | Income Tax – II | 2 | 1.8 | |

7. | Cost Accounting – II | 2 | 2.0 | |

B.Com Programme Outcomes (POs) (As Per NEP)

PO1. Disciplinary Knowledge:

Graduates willdevelop the specialization and in-depth content knowledge of subjects in commerce and they build up the capability of executing comprehensive knowledge and understanding of newdisciplineof Commerce.

PO2.Communication Skills:

Graduates will acquire the ability to communicate ideas effectively in both written and oral formats and they will be proficient in communicating through presentations, seminar, written reports.

PO3. Critical Thinking:

Graduatewill gain the ability to analyze information objectively and make a reasoned judgment andthey improve independent thinking by understanding the concepts in every area of Commerce and Business.

PO4. Problem Solving skill:

Graduate will possess the capability to deduce a business problem and apply the class room learning into practice to offer a solution for the same.

PO5. Research and Development:

Graduate will acquire the ability to conduct independent research and explore the emerging branches in the field of commerce and business. They also improves the ability of search, extract, organise and analyze the data and information.

PO6. Information and Communication Technology (ICT) Digital Literacy:

Graduates improve the capability to use various technical (ICT) tools like PPT presentation, Zoom class etc. They also learn how best they can use online platform for leaning.

PO7. Self-Directed Learning:

Graduates will build the capability to work independently in diverse projects and ensure detailed study of various facets of Commerce and Business. Capability of self-paced and self-directed learning aimed at personal development and for improving knowledge/skill development and rescaling in all areas of commerce.

PO8. Moral and Ethical Awareness/Reasoning:

Gradates develop the ability to ascertain what is ethical and unethical behavior, what is good and bad in business, and demonstrate awareness of the social, legal and ethical implication of commerce and business to make responsible decision in their professional careers.

PO9. Teamwork and Collaboration:

Graduates will acquire the ability to work in interdisciplinary teams in the most effective and efficient way to achieve a common goals and collaborating with individual from different backgrounds to solve complex problems.

PO10. Leadership and Managerial skills:

Graduates build the leadership qualities within them to lead the team, project and resource efficiently, they also develop the ability to plan, organize and execute the resource (Men, Money and Material) effectively.

Programme Specific Outcomes

Upon completion of B.Com Degree Programme the graduates will be able to develop the following programme specific outcomes.

PSO1.Develop and implement traditional and modern strategies and skills practices of Accounting, Costing, Banking, Economics, Marketing, Management, Finance, Auditing and Taxation.

PSO2. Practice different techniques of Communication, Leadership and Managerial skills and apply it in business and profession.

PSO3. Apply different concepts in starting and managing business and realize the social responsibilities, social realities and inculcate an essential value system.

Course to Programme Outcome Mapping

| Courses / PO’s | PO1 | PO2 | PO3 | PO4 | PO5 | PO6 | PO7 | PO8 | PO9 | PO10 |

| Financial accounting |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Management principal and application |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

| Principal of marketing |

✓ |

✓ |

|

✓ |

✓

|

✓ |

✓ |

✓ |

✓ |

✓ |

| Accounting for Everyone |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Advance Financial Accounting |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Corporate Administration |

✓ |

|

|

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

| Law & Practice of Banking |

✓ |

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

| |

| Financial Environment |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Corporate Accounting |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Cost Accounting |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Entrepreneurial Skill (OE) |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

| Advance Corporate Accounting |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

| Costing Methods and Techniques |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

✓ | |

Business Regulatory Framework |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

| Financial Education and Investment Awareness (SEC) |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

Course Outcome (COs)

Semester : 1

Course Name : Financial Accounting

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understanding of theoreticalframework of accounting as well as accounting standards. | PO1, PO3, PO7, PSO1, | K2 |

CO – 2 | Demonstrate the preparation of financial statement of manufacturing and non-manufacturing entities of sole proprietors. | PO1, PO3, PO7, PSO1, | K3 |

CO – 3 | Exercise the accounting treatments for consignment transactions and events in the books for consignor and consignee. | PO1, PO3, PO7, PSO1, | K3 |

CO – 4 | Understand the accounting treatment for royalty transactions and articulate the Royalty agreement. | PO1, PO3, PO4, PO7, PSO1, | K3 |

CO – 5 | Outline the emerging trends in the fields of accounting. | PO1, PO3, PO7, PSO1, | K2 |

Semester : 1

Course Name : Management principles and Applications

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand and identify the difference theories of organizations, which are relevant in the present context. | PO1, PO4, PO9, PSO1, PSO2 | K2 |

CO – 2 | Design and demonstrate the strategic plan for the attainment of organizational goals. | PO1, PSO1 | K4 |

CO – 3 | Differentiate the different types of authority and chose the best one in the present context. | PO1, PO7, PSO1 | K2 |

CO – 4 | Compare and chose the difference types of motivation factors and leadership styles. | PO1, PO9, PSO1 | K4 |

CO – 5 | Choose the best controlling techniques for better productivity of organizations. | PO1, PO2, PO9, PSO1 | K4 |

Semester : 1

Course Name : Principal of Marketing

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understanding of basic concepts of marketing and asses the marketing environment. | PO1, PO2, PSO1, PSO2 | K2 |

CO – 2 | Analyze the consumer behavior in present scenario and marketing segmentation. | PO3, PO4, PO9, PO10, PSO1 | K4 |

CO – 3 | Discover the new product development and identify the factors affecting the price of product in the present context. | PO1, PO9, PO10, PSO1 | K2 |

CO – 4 | Judge the impact of promotional techniques on the customers & importance of channels of distributions. | PO1, PSO1

| K2 |

CO – 5 | Outline the recent development in the field of marketing. | PO1, PO5, PSO1 | K4 |

Semester : 1

Course Name : Accouting for Everyone/ Financial Literacy

Total Hours : 42

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand various terms used in accounting. | PO1, PO3, PO7, PSO1, | K2 |

CO – 2 | Make accounting entries and prepare cash book and other accounts necessary while running a business. | PO1, PO3, PO7, PSO1, | K3 |

CO – 3 | Prepares accounting equation of various business transactions. | PO1, PO3, PO7, PSO1, | K3 |

CO – 4 | Analyses information from company’s annual report: | PO1, PO3, PO4, PO7, PSO1, | K3 |

CO – 5 | Comprehend the management report of the company. | PO1, PO3, PO7, PSO1, | K2 |

Semester : 2

Course Name : Advanced Financial Accounting

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Describe the two primary function of financial accounting. | PO1, PO2, PSO1, PSO2 | K2 |

CO – 2 | Determine how financial accounting information is communicated through financial statements. | PO3, PO4, PO9, PO10, PSO1 | K4 |

CO – 3 | Describe the components that’s supplement the financial statements in an annual report. | PO1, PO9, PO10, PSO1 | K2 |

CO – 4 | Apply conceptual principle when selecting appropriate accounting policies. | PO1, PSO1

| K2 |

CO – 5 | Explain the concept of business combination. | PO1, PO5, PSO1 | K4 |

Semester : 2

Course Name : Corporate Administration

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the framework of Companies Act 2013 and different kind of companies. | PO1, PO5, PSO1 | K2 |

CO – 2 | Identify the stages and document involved in the formation of companies in India. | PO1, PO3, PO4, PSO1 | K2 |

CO – 3 | 1. Analyze the role, responsibilities and function of key management personnel in corporate administration. | PO1, PO3, PO4, PSO1 | K4 |

CO – 4 | Examine the procedure involved in the corporate meeting and the role of company secretary in the meeting. | PO1, PO3, PO4, PSO1 | K4 |

CO – 5 | Evaluate the role of liquidator in the process of winding up of the company, | PO3, PO4, PO8, PSO1 | K5 |

Semester : 2

Course Name : Law and Practice of Banking

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Summarize the relationship between Banker, Customer and different types of functions of banker. | PO1,PO5, PO7 PSO1 | K2 |

CO – 2 | Analyze the role, function and duties of paying and collecting banker. | PO1, PO5, PSO1 | K4 |

CO – 3 | Make use of the procedure involved in opening and operating different accounts. | PO1, PO4, PO5, PSO1 | K4 |

CO – 4 | Examine the different types of negotiable instrument and their relevance in the present context. | PO5, PO9, PSO1 | K4 |

CO – 5 | Estimate possible development in the banking sector in the upcoming days. | PO4, PO5, PSO1 | K3 |

Semester : 2

Course Name : Financial Environment

Total Hours : 42

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the fundamentals of Indian Economy and its significance | PO1, PSO1 | K2 |

CO – 2 | Evaluate the impact of monetary policy on the stakeholders of the economy. | PO1, PO3, PO4. PSO1 | K3 |

CO – 3 | Assess the impact of fiscal policy of the on the stakeholder of the economy. | PO1, PSO1 | K2 |

CO – 4 | Examine the status of inflation, unemployment and labour market in India. | PO1, PSO1 | K2 |

CO – 5 | Inference the financial sector reforms in India. | PO1, PO3, PO4, PSO1 | K4 |

Semester : 3

Course Name : Corporate Accounting

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the treatment of underwriting of shares. | PO1, PO5, PSO1 | K2 |

CO – 2 | Comprehend the computation of profit prior to incorporation. | PO1, PO3, PO4, PSO1 | K2 |

CO – 3 | Know the valuation of intangible assets. | PO1, PO3, PO4, PSO1 | K4 |

CO – 4 | Know the valuation of shares. | PO1, PO3, PO4, PSO1 | K4 |

CO – 5 | Prepare the financial statement of companies as per companies act, 2013. | PO3, PO4, PO8, PSO1 | K5 |

Semester : 3

Course Name : Cost Accounting

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the concept of cost accounting and methods of costing. | PO1, PO4, PO8, PSO1 | K2 |

CO – 2 | Outline the procedure and documentations involved in procurement of materialize and compute the valuation of inventory. | PO1, PO5, PO6, PSO1 | K4 |

CO – 3 | Make use of patrol procedure and compute idle and over time. | PO2, PO3, PSO1 | K4 |

CO – 4 | Discuss the methods of allocation, apportionment and absorption of overheads. | PO3, PO7, PSO1 | K2 |

CO – 5 | Prepare cost sheet and discuss cost allocation under ABC. | PO1, PO10 | K4 |

Semester : 3

Course Name : Entrepreneurial Skill (OE)

Total Hours : 42

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the various aspects to set-up and Enterprises. | PO1, PO7, PSO3 | K2 |

CO – 2 | Discover their strength and weakness in developing the entrepreneurial mind-set. | PO7, PO8, PSO3 | K4 |

CO – 3 | Identity the different Government Institution / scheme available for promoting entrepreneurs. | PO3, PO4, PSO3 | K4 |

CO – 4 | Familiarize mechanism of monitoring and maintaining enterprises. | PO1, PO5, PSO1 | K5 |

CO – 5 | Know the various features for successful/unsuccessful entrepreneurs. | PO1, PO7 | K4 |

Semester : 4

Course Name : Advance Corporate Accounting

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Know the procedure of redemption of preference shares. | PO1, PO4, PO9, PSO1, PSO2 | K2 |

CO – 2 | Comprehend the different methods of Mergers and Acquisition. | PO1, PSO1 | K4 |

CO – 3 | Understand the process of internal reconstruction. | PO1, PO7, PSO1 | K2 |

CO – 4 | Prepare the liquidators final statement of accounts. | PO1, PO9, PSO1 | K4 |

CO – 5 | Understand the recent developments in accounting and accounting standards. | PO1, PO2, PO9, PSO1 | K4 |

Semester : 4

Course Name : Costing Methods and Techniques

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the method of costing applicable in different industries. | PO1, PO3, PO4, PSO1 | K2 |

CO – 2 | Determination of cost by applying different methods of costing. | PO3, PO4, PO5, PSO1 | K4 |

CO – 3 | Prepare flexible and cash budget with imaginary figures. | PO3, PO4, PO5, PSO1 | K5 |

CO – 4 | Analyze the processes involved in standard costing. | PO3, PO4, PO7, PSO1 | K4 |

CO – 5 | Familiarize with the activity based costing and its applications. | PO1, PO2, PO6, PSO1 | K4 |

Semester : 4

Course Name : Business Regulatory Framework

Total Hours : 56

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the laws relating to contracts and its application in business activities. | PO1, PO2, PSO1 | K2 |

CO – 2 | Acquire knowledge on bailment and indemnification of goods in a contractual relationship and role of agents. | PO1, PO3, PO4, PSO1 | K2 |

CO – 3 | Comprehend the rules for Sale of Good and right and duties of a buyer and a seller. | PO1, PO3, PO4 | K4 |

CO – 4 | Distinguish the partnership laws, Its applicability and relevance | PO1, PO3, PO4, PSO1 | K4 |

CO – 5 | Rephrase the cyber law in the present context. | PO1, PO3, PO4, PSO1 | K4 |

Semester : 4

Course Name : Financial Education and Investment Awareness (SEC)

Total Hours : 45

CO Number | Course Outcomes | PO/PSO Addressed | Cognitive Level |

CO – 1 | Understand the basic concepts of Finance and Investment | PO1, PSO1 | K2 |

CO – 2 | Provide the foundation for financial decision making | PO1, PO3, PO4, PSO1 | K2 |

CO – 3 | Analyze the various saving and investment alternatives available for common man. | PO1, PO3, PO4, PSO1 | K4 |

CO – 4 | Acquire the detailed knowledge of stock markets and stock selection. | PO1, PO3, PO4, PSO1 | K2 |

CO – 5 | Orient the learners about mutual funds and criteria for selection. | PO1, PO3, PO4, PSO1 | K2 |

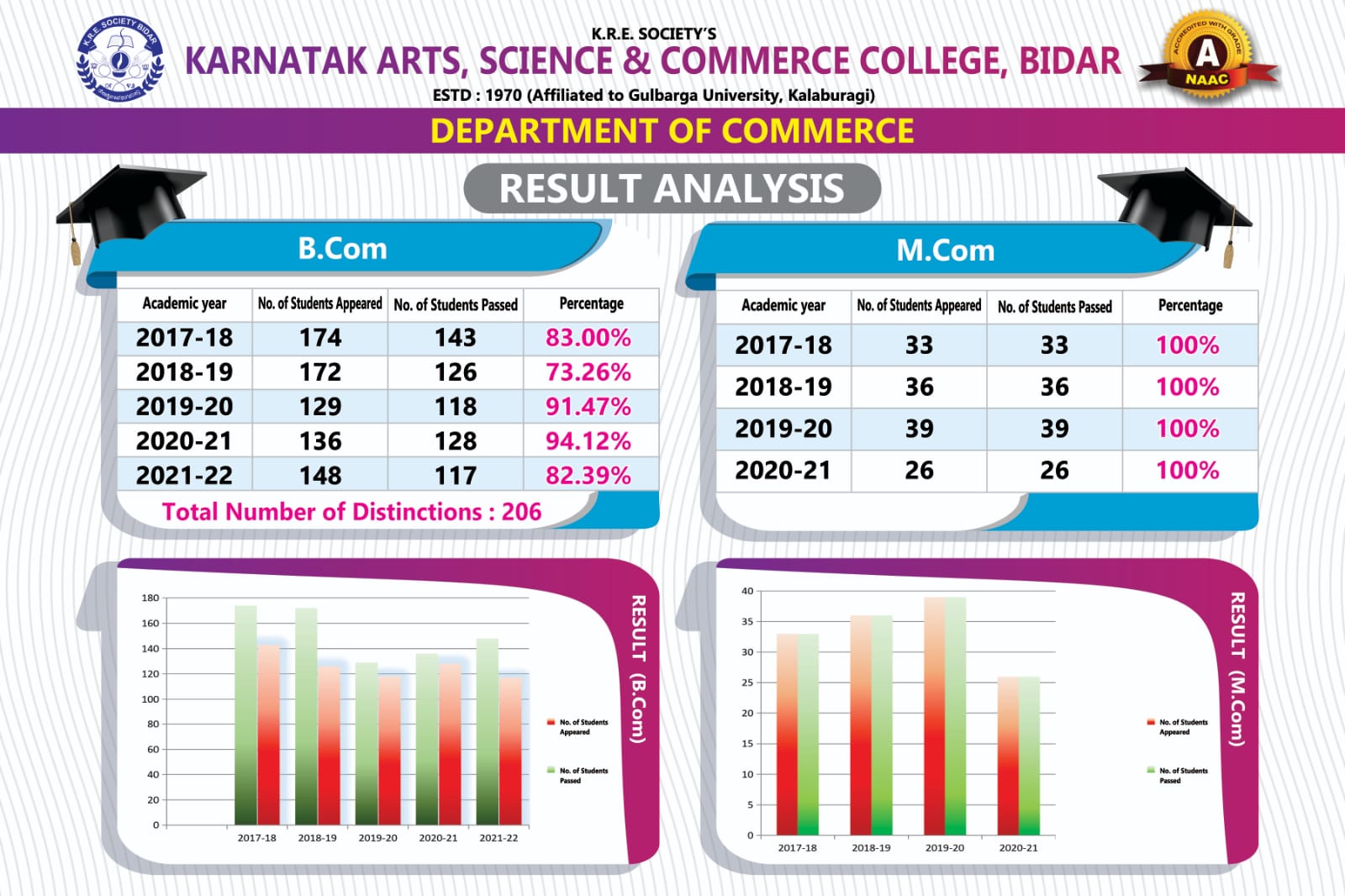

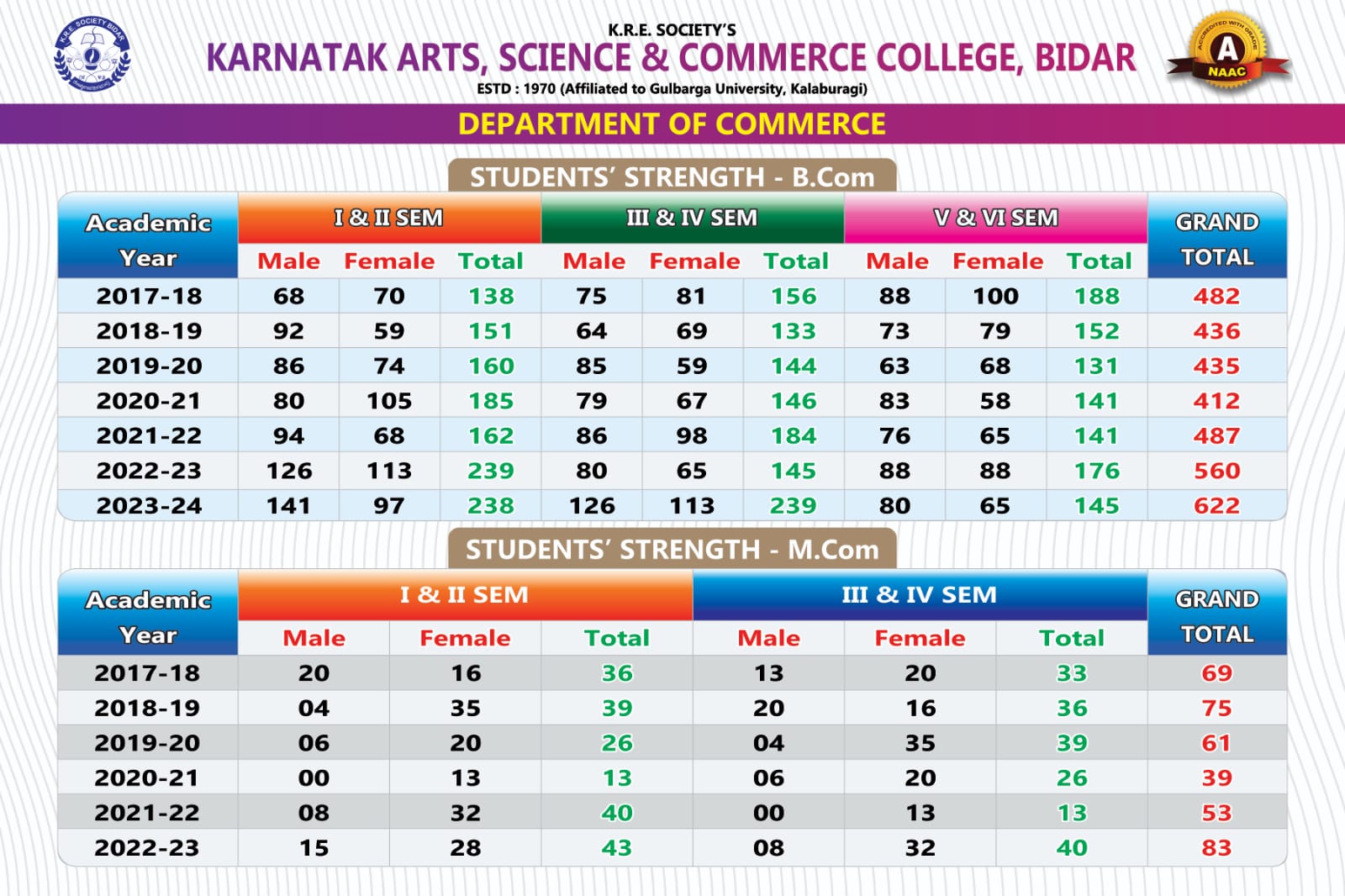

The Department of Commerce, Karnatak Arts, Science and Commerce College, Bidar came into existence in 1970 to offer B.Com program and has been touching heights since then. It started the post-graduation program M.Com in 2012. Today, the Department of Commerce has evolved as an axis of excellence. We offer the best quality Education and Training to students for shaping their careers for a sustainable corporate world. The Department of Commerce aims to provide academically efficient and professionally relevant teaching in the areas of Accounting and Finance.

The Department of Commerce, Karnatak Arts, Science and Commerce College, Bidar came into existence in 1970 to offer B.Com program and has been touching heights since then. It started the post-graduation program M.Com in 2012. Today, the Department of Commerce has evolved as an axis of excellence. We offer the best quality Education and Training to students for shaping their careers for a sustainable corporate world. The Department of Commerce aims to provide academically efficient and professionally relevant teaching in the areas of Accounting and Finance.

During study at the department, the students are encouraged to get hands-on experience in the corporate world through internship projects with reputed organizations. They are also encouraged to take-up mini projects to supplement theoretical knowledge with practical experience as a part of their curriculum. Our graduates are working in multinational companies, some are entrepreneurs and many have chosen higher studies in commerce.

With the support from faculty, staff, students, and all other stakeholders, we strive to build further on the strong foundations of Department of Commerce and accomplish greater altitudes of distinction. On behalf of the entire department, I take this opportunity to invite you to our campus and become a part of this transformational journey.

With warm regards and best wishes,

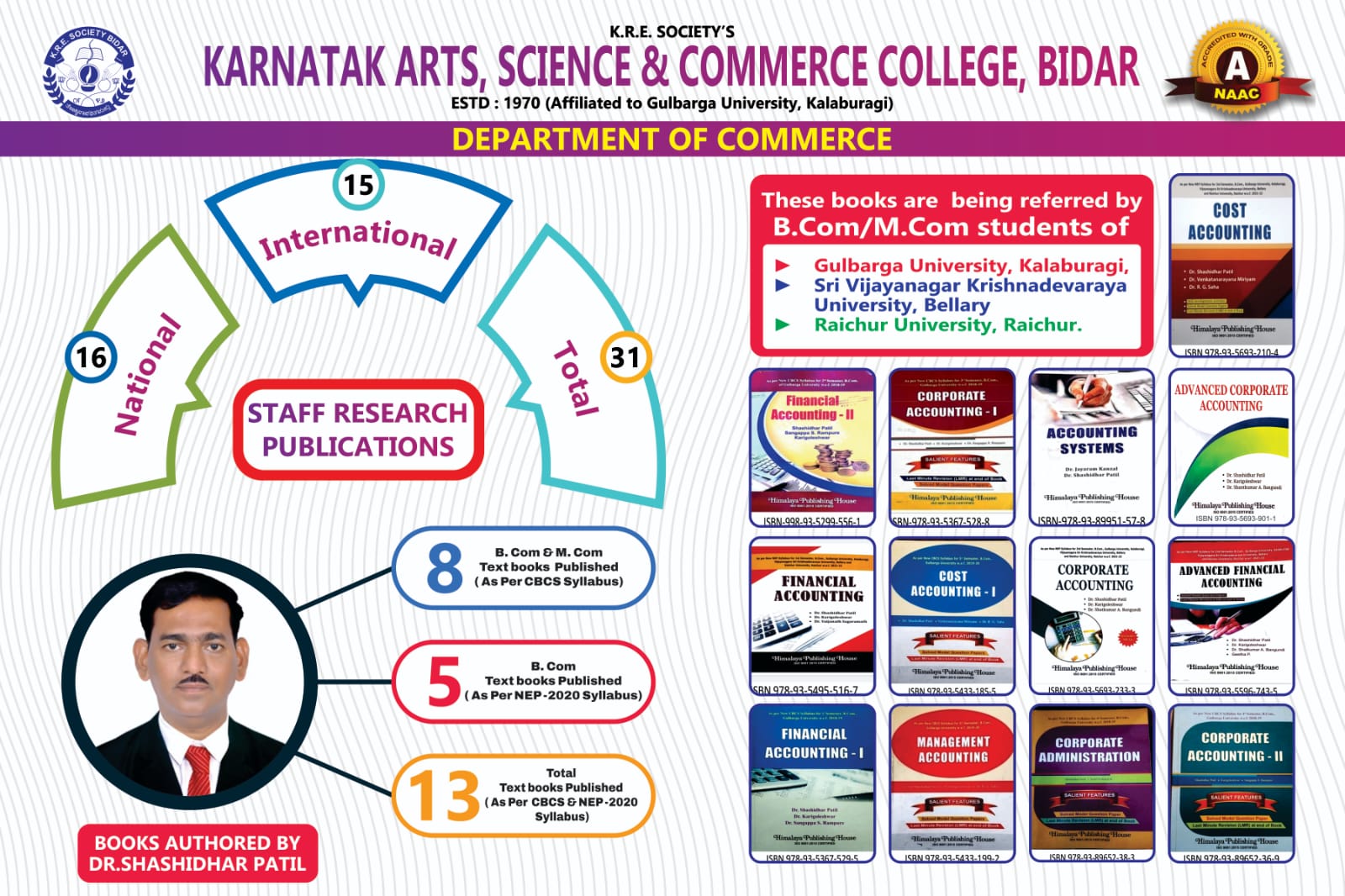

Dr. Shashidhar Patil M.com, M.Phill., Ph.D.,

Sl.No. | Particulars / Name of the Item | Quantity |

01 | Computers | 17 |

02 | Projectors | 10 |

03 | A/C | 01 |

04 | UPS | 01 |

Sl.NO | YEAR | Higher Education (In Percentage) | Placement (In Percentage) | Total Percentage |

1. | 2017-18 | 18.6% | 6.3% | 24.9% |

2. | 2018-19 | 25% | 14.4% | 39.4% |

3. | 2019-20 | 38.1% | 3.8% | 41.9% |

4. | 2020-21 | 26.24% | 4.2% | 30.44% |

5. | 2021-22 | 18.43% | 6.3% | 24.73 |

Academic year | Sl. No. | Name of the activity | Date | Resource person | No. of Students participated |

2017-18 | 1. | Role of Income Tax in Nation Building | 22-07-2017 | Sri Srinivas Rao (Income tax officer) | 30 |

2018-19 | 2. | Guest talk on Self Help Group | 20-08-2018 | Mrs. Rosemery | 25 |

3. | Two days Training Program on Financial Inclusion & Indian Banking | 14-02-2019 & 15-02-2019 | Shri Umakanth Nagmarpalli (Director of DCC & NSSK, Bidar) Sri Subramanyam Prabhu (Director of SAHARDA REST DCCB) | 120 | |

4. | Barnstormer 2K19 Commerce Quiz | 18-03-2019 | – | 84 | |

5. | Indian Taxation System | 25-03-2019 | Sri Padmakar Kulkarni (Joint Commissioner of Commercial Taxes(Enf.)Kar) Sri V. Sreenivasa Rao (Income Tas Officer) | 50 | |

2019-20 | 6. | Guest Talk on Communication Skill for Business | 23-08-2019 | Prof. Parag. S. Shah (Modern College, Pune)

| 87 |

7. | Guest Lecture on Women Career In Commerce | 24-08-2020 | Preeti Parag shan (SNDT Arts & Commerce college, Pune) |

| |

8. | Guest Talk on Career Development & Job Opportunities | 28-01-2020 | Ms. Subhanalla L.N. (Deshpande Educaonal Trust, Hubballi) |

| |

9. | Industrial Visit & Field Work | 31-07-2019 | – | 30 | |

10. | Conduct the two days FDP on Tally ERP & GST | 06-02-2020 | – | 22 | |

2020-21 | 11. | ONLINE Guest Talk on Investors Awareness Program | 15-02-2021 | Ms. Priya Aski (Certified Corporate Trainer) | 50 |

12. | ONLINE Guest Talk on Research Methodology | 15-02-2021 | Dr. Panduranga Patti (Asst. Prof. Central University of Kalburgi) | 12 | |

2021-22 | 13. | Special Lecture on The Role of E-Resources in Higher Education | 23-09-2021 | Prof. Mallikarjun N.L. (Chairperson & Dean, Dept of MBA, KSAWU Vijayapura) | 35 |

14. | CA-CPT Awareness Progamme | 08-12-2021 | CA Girish Mangikar CA Shivkumar Boranchi | 95 | |

15. | Poster Making Competition | 27-12-2021 | Mrs. Geeta Inapure (H.O.D. of M.B.A., GNDEC, Bidar) | 98 | |

16. | Innovative Business Idea | 12-01-2022 | Mrs. Akanksha Shrivastava

| 18 | |

17. | One Day Workshop on Union Budget Analysis | 21-02-2022 | CA Kamal Kishor Attal (Alumni and President Bidar CA Association) | 115 | |

18. | ONLLINE Guest Talk on Entrepreneurship | 22-03-2022 | Gourav kanthaliya | 94 | |

19. | One day Workshop on Managerial Economics | 09-04-2022 | M. Vijay Kumar | 30 | |

20. | Guest Talk On Financial Literacy | 19-04-2022 | H.G. Dabage | 25 | |

21. | Competition on Entrepreneurship | 24-11-2022 | – | 35 |